TL;DR

Kaia launched with one of the strongest distribution theses in Web3: combine enterprise-grade Layer‑1 infrastructure with Web2 reach (LINE + Kakao) to convert mainstream users into sustained on-chain activity. Two years later, the platform still looks technically capable — but the conversion thesis has not clearly played out, and the ecosystem now needs a credible “what comes next” strategy.

This article is a 2026 reality check: what Kaia got right, what failed to materialize, and what signals would indicate a genuine turnaround. The risk is not a sudden collapse — it’s drifting toward a “point of no return” where strong tech persists, but ecosystem gravity never arrives (a trajectory some observers compare to Kadena-style stagnation).

- What worked: distribution access, low-friction onboarding, and a credible “Web2 → Web3” UX story.

- What’s missing: durable retention loops, liquidity depth, and a breakout application category that compounds adoption.

- What to watch: evidence of sustained user activity, developer pull, and value capture beyond incentive spikes.

Kaia’s thesis: world-class infrastructure built for mass onboarding — but still waiting for ecosystem gravity.

Why Kaia’s Web2 distribution (LINE + Kakao) and low-friction Layer‑1 design matter for mainstream adoption in Asia.

Disclosure: This is editorial analysis based on publicly available documentation, ecosystem updates, and third-party reporting. Where claims are speculative or based on commentary, they are framed as such. For a verification checklist, see verification steps.

Update note (January 2026): This analysis reflects public information available as of January 2026. We’ll update the piece as Kaia publishes major roadmap, governance, or ecosystem partnership changes.

Kaia ecosystem map: partners and integrations across Asia.

Key Findings

Kaia’s launch narrative centered on distribution: convert mainstream reach (LINE + Kakao) into a self-reinforcing on-chain economy. Two years later, the strongest public signals still suggest a gap between access and compounding behavior.

These findings summarize what appears to be working, what has not yet materialized, and what would most credibly change the outlook.

- The original thesis: Kaia would convert Web2 distribution (LINE + Kakao) into sustained on-chain usage and a self-reinforcing ecosystem.

- The 2026 reality: Kaia remains technically capable, but public adoption signals have not clearly translated into durable ecosystem gravity.

- Distribution is not adoption: onboarding access can create bursts of activity, but retention, liquidity depth, and developer pull are the real compounding loops.

- Strategic risk: Kaia may be approaching a “point of no return” where the market stops waiting for the thesis to arrive — a pattern seen in other technically strong but ecosystem-weak chains.

- What would change the outlook: clearer prioritization (one breakout wedge), measurable retention improvements, and credible value capture beyond incentive-led activity.

- Why this matters: in a market where the “tide lifts all boats” assumption has weakened, only ecosystems with real gravity tend to compound; the rest stagnate.

Kaia Chain Review (2026): What Changed Since Launch?

Kaia is no longer a “new launch” story. Two years in, the question is whether the original distribution thesis has translated into compounding ecosystem gravity — or whether the project is drifting into a long stagnation cycle.

The location problem: distribution access exists, but the surrounding ecosystem remains thin.

- Then (launch thesis): LINE + Kakao distribution would convert mainstream users into sustained on-chain activity.

- Now (2026 reality check): Kaia remains technically capable, but public economic signals (liquidity, fees, durable usage) still look small relative to the narrative.

- The strategic gap: access has not reliably become retention; onboarding has not reliably become economic gravity.

- What would change the thesis: one breakout wedge (payments/stablecoins or mini-app economy) showing measurable compounding behavior.

Key Metrics Snapshot (2026)

Why this matters: Kaia’s thesis depends on converting distribution into durable economic activity. These are the simplest public proxies for “ecosystem gravity” (liquidity, usage, fees) — shown alongside TON (messaging distribution) and Solana (high-velocity on-chain economy).

Strong infrastructure can be fully built — and still remain underutilized without retention and liquidity loops.

Market & DeFi activity (public dashboards)

| Metric | Kaia | TON | Solana |

|---|---|---|---|

| DeFi TVL | $15.62m | $79.38m | $8.311b |

| Stablecoins market cap (on-chain) | $140.24m | $934.72m | $14.022b |

| DEX volume (24h) | $294,785 | $2.15m | $4.562b |

| Chain fees (24h) | $319 | $6,332 | $1.39m |

| Chain revenue (24h) | $277 | $3,166 | $92,376 |

| Active addresses (24h) | — (not consistently reported in public dashboards) | — | 2.76m |

| Transactions (24h) | — | — | 93.73m |

Network-scale & decentralization signals (on-chain analytics)

| Metric | Kaia | TON | Solana |

|---|---|---|---|

| Real-time TPS (1H) | 2.92 tx/s | 12.08 tx/s | 1,141 tx/s |

| Total transactions (all-time) | 2.82B | 2.88B | 102B |

| Validators | 40 | 383 | 787 |

| Nakamoto coefficient | 1 | 75 | 19 |

| Average transaction fee | $0.003606 | $0.003622 | $0.01124 |

Interpretation: Kaia’s distribution story is still compelling, but its public liquidity and fee signals remain small relative to what “mass onboarding” narratives usually imply. TON is a closer messaging-distribution analogue (Telegram), and while its DeFi footprint is still modest, its stablecoin base and decentralization metrics look meaningfully stronger. Solana is included as the clearest example of what compounding ecosystem gravity looks like in practice: deep liquidity, high transactional velocity, and material fee generation.

Acquisition without compounding: attention arrives, but repeat usage fails to lock in.

Retention / conversion collapse: acquisition without compounding

One of the clearest failure modes for distribution-first chains is acquisition without retention. In Kaia’s case, multiple third-party reports and ecosystem summaries have described a pattern where incentive-led onboarding created short spikes in activity, followed by sharp drop-offs when campaigns ended. We treat these figures as reported / third-party estimates, but the pattern aligns with the broader public metrics: low fees, shallow liquidity, and limited durable throughput.

| Phase | Observed pattern | What it implies |

|---|---|---|

| Onboarding surge | Large bursts of new wallets/users during incentive campaigns | Distribution can create attention, but not necessarily habit loops |

| Activity spike | Short-lived jumps in transactions / mini-app usage | Campaign-driven activity can inflate “usage” without durable demand |

| Post-campaign drop | Sharp declines in activity after rewards fade | Weak retention signals a missing wedge (no compounding loop) |

Definition: “Point of no return” for an L1 ecosystem

In practice, a chain reaches a point of no return when the market stops waiting for the thesis to arrive. It’s not a technical failure — it’s a compounding failure.

- Retention stays weak: activity remains incentive-led, with no durable D30/D90 habit loops.

- Builders stop betting: independent developers treat the chain as opportunistic rather than durable infrastructure.

- Distribution advantage decays: partners reduce visibility, priorities shift, or attention moves to other ecosystems.

Messaging distribution can work — but only when it produces durable economic gravity.

What the TON comparison implies for Kaia’s LINE strategy

We include TON in this update because Telegram mini-apps became one of the most visible consumer Web3 onboarding narratives — and Kaia’s early strategy aimed to achieve a similar outcome via LINE (a dominant chat platform in Japan and Thailand) and Kakao. Both projects share “messaging distribution” as a thesis, but the market learned that this trend can burn out quickly when mini-app quality is low, teams are weak, and incentives substitute for product value. That makes TON the fairest real-world analogue for evaluating Kaia’s conversion layer in 2026.

| Dimension | TON (Telegram distribution) | Kaia (LINE + Kakao distribution) |

|---|---|---|

| Core thesis | Messaging-native onboarding → wallets + mini-app economy | Enterprise distribution → mainstream onboarding in Asia |

| Conversion risk | Quality and safety of mini-app ecosystem | Distribution without retention; partner dependency |

| Economic gravity (proxy) | Stronger stablecoin base and decentralization signals | Smaller liquidity/fee footprint relative to narrative |

| What matters most | Repeat usage without incentives | Breakout wedge + durable retention loops |

Kaia and TON share a similar high-level thesis: messaging distribution can become a Web3 onboarding engine. Telegram’s integration with TON created a clear, repeatable pathway for users to discover wallets, transact, and engage with mini-app experiences without leaving a familiar interface. Kaia’s equivalent ambition is to turn LINE’s user base into an on-chain economy — but the metrics above suggest a persistent gap between access and economic gravity.

The difference is not only product design — it is compounding behavior. TON has built a larger stablecoin base and a meaningfully stronger decentralization profile, which makes it easier for third-party builders and liquidity providers to treat the chain as durable infrastructure rather than a corporate distribution experiment. For Kaia, the strategic risk is that the ecosystem becomes “always almost ready”: high distribution potential, but no breakout loop that retains users and capital after incentives fade.

Turnaround triggers (signals that the thesis is working)

To avoid drifting toward a “point of no return”, Kaia would likely need to show multiple measurable improvements that compound over time (not one-off campaigns). Examples of public signals include:

- Stablecoin growth: sustained stablecoin market cap expansion toward the $500m+ range (suggesting real payments and settlement usage).

- Liquidity depth: TVL growth into $200m+ territory with diversified protocols (not concentrated in one incentive pool).

- Usage velocity: sustained DEX volumes above $50m/day and fees/revenue that rise with activity (evidence of real economic throughput).

- Developer pull: visible growth in independent apps that users seek out (not only apps pushed through distribution channels).

- Governance credibility signals: improvements in decentralization signals (validator diversity, Nakamoto coefficient) to reduce corporate-dependency risk.

Source snapshot (as of late January 2026): public DeFi market dashboards for TVL, stablecoins, DEX volume, fees and revenue TVL and stablecoin dashboards and network analytics snapshots for TPS, validators, decentralization, total transactions and average fees validator and decentralization metrics.

Jump to: Key findings · Metrics snapshot · Introduction · Core technologies · Ecosystem · Use cases · Market comparison · Roadmap · Risks · Conclusions · FAQs · References

Introduction: What Is Kaia Chain and How Its Blockchain Ecosystem Works

Why Kaia Chain matters in the Asian Web3 landscape: Kaia is no longer a “new launch” story. It is a two‑years‑in ecosystem experiment built on a bold original thesis: use Web2 distribution (LINE + Kakao) to onboard mainstream users into a self‑reinforcing on‑chain economy.

That thesis remains plausible in theory, but by early 2026 the public signals that typically accompany compounding ecosystems — liquidity depth, fee generation, and sustained usage — appear materially smaller than the narrative would imply.

Kaia’s distribution thesis: scaling onboarding via LINE and Kakao

This matters because distribution alone does not compound. In most successful networks, retention loops (repeat usage), liquidity loops (capital staying put), and developer loops (builders shipping and attracting users) reinforce each other.

Kaia’s ecosystem still shows ambition and technical capability, but the “conversion layer” — turning access into durable economic gravity — has not clearly emerged at scale. The rest of this article reframes Kaia through that lens: what can be measured today, what is still unproven, and what would need to change to avoid slow stagnation.

Kaia’s core mission is to make blockchain adoption accessible and seamless for both Web2 and Web3 users, addressing a key gap in the industry. Traditional blockchain solutions are often complex, creating high barriers to entry for developers and businesses eager to innovate with decentralized technology. Kaia’s platform addresses this by offering a streamlined, industry-ready infrastructure that enables developers to create and manage scalable applications without sacrificing security or performance.

Strategic partnerships with Kakao and LINE remain Kaia’s defining advantage — but they also create a key analytical question: does distribution convert into retention? Messaging integrations can deliver user acquisition, yet ecosystems typically only compound when users keep transacting after incentives fade and when third‑party builders choose the chain for reasons beyond partner reach. For Kaia, the core challenge is proving that enterprise distribution is translating into independent developer pull, durable liquidity, and repeat on‑chain behavior.

Why distribution chains still fail: authenticity, trust, and scalability constraints

The blockchain industry faces significant market challenges, particularly around ensuring content authenticity and achieving technical scalability. As decentralized applications grow in popularity, the ability to verify and trust digital content has become a critical concern. Users and businesses alike are wary of issues related to data integrity, security, and transparency, especially when content authenticity directly affects user engagement and brand reliability. This is essential as blockchain technology, although promising, is often met with caution due to its relatively new and complex frameworks.

Scalability is another pressing challenge for blockchain technology. The decentralized nature of blockchain can lead to network congestion and high transaction costs as the user base expands, often hampering widespread adoption. For blockchain platforms to support extensive real-world applications, they must deliver scalable infrastructure that can handle high transaction volumes efficiently without sacrificing speed or security. Addressing these dual concerns of authenticity and scalability is pivotal for platforms to gain confidence and function as dependable digital infrastructure. For context, similar networks have struggled with congestion during peak activity, suggesting that architectural decisions matter significantly for long-term performance.

To address these challenges, Kaia has developed a blockchain framework focused on enhancing both scalability and trust. By designing a high-performance, adaptable infrastructure, Kaia provides a solution capable of handling extensive user traffic and transaction volumes. This approach mitigates congestion issues and supports efficient, large-scale decentralized applications. Additionally, Kaia emphasizes authenticity and transparency in content, building a secure ecosystem where users can trust the integrity of digital interactions. Through these innovations, Kaia plays a vital role in advancing blockchain technology’s viability for diverse, real-world applications.

Kaia Chain Core Technologies: Architecture, Scalability and Security

Kaia’s technology stack was built to support a Web2-style onboarding funnel: low-friction UX, predictable performance, and developer ergonomics that fit enterprise distribution. The practical 2026 question is not whether the chain can run fast — it is whether these design choices translate into durable usage and measurable value capture.

To keep this section grounded, we describe Kaia’s core building blocks (consensus, smart contracts, structure, security, interoperability) without assuming outcomes like “liquidity support” or mass adoption. Technology can enable growth, but the ecosystem must still prove conversion and compounding behavior.

Kaia’s approach to Web2–Web3 interoperability

Summary: Kaia’s technical design emphasizes low-friction onboarding, fast finality, and developer usability — a sensible fit for consumer-facing applications distributed through Web2 channels. In 2026, the key question is less “can the chain run fast?” and more whether these product choices translate into durable usage, liquidity, and third‑party developer pull.

Consensus Mechanism

Kaia employs a Proof-of-Stake (PoS) consensus mechanism, a scalable and energy-efficient protocol that supports network security through validator staking. This model aligns with Kaia’s mission for sustainability, encouraging validator participation while keeping energy consumption low.

Smart Contract Functionality

Kaia’s platform includes a versatile smart contract framework that enables developers to build and deploy applications with minimal friction. With capabilities designed to support complex contract logic and automated execution, Kaia’s smart contract infrastructure is suitable for diverse use cases, from DeFi to gaming, supporting secure and transparent transactions.

Blockchain Structure

Kaia’s architecture is a Layer 1 framework, designed to provide a secure and scalable environment without relying on external protocols. This approach ensures high reliability and efficiency, making it an ideal base for decentralized applications. The platform’s structure minimizes latency and optimizes performance, effectively addressing scalability concerns.

Security Features and Innovations

Kaia’s security posture is typically described in terms of standard safeguards such as secure key management, encryption, and operational controls. As with most L1 ecosystems, application-level security also depends on the practices of individual teams — including code review, formal verification where appropriate, and independent audits for high-value contracts.

Interoperability

To support a wide-ranging ecosystem, Kaia is built for interoperability with other blockchain protocols. This allows developers to integrate cross-chain assets and services, bridging Web2 and Web3 ecosystems and expanding Kaia’s reach across decentralized networks.

Through its technical framework, Kaia aims to provide a reliable, scalable foundation for consumer and enterprise applications. Interoperability can be a deciding factor for teams building across ecosystems — but in 2026 it is still the broader conversion layer (retention, liquidity depth, and developer pull) that determines whether interoperability translates into durable adoption.

Kaia Tokenomics and Incentive Models

Kaia Chain’s tokenomics centers on the $KAIA token, which is used for transaction fees, staking (network security), and governance. As with most Layer‑1 networks, the long-term question is value capture: whether real usage grows sustainably enough that demand persists beyond incentives.

Purpose and Utility of $KAIA – The $KAIA token operates as the native currency within the Kaia ecosystem, facilitating core activities like transaction processing and network governance. By enabling governance through token-holding votes, $KAIA empowers the community to shape critical platform decisions, reinforcing user alignment with Kaia’s objectives. Additionally, staking provides a dual benefit: rewarding users who lock up their tokens to secure the network and improving network resilience through distributed security.

Token Distribution Model and Emission Schedule – Kaia Chain follows a balanced distribution model, with initial allocations for early supporters, team reserves, and ecosystem development. The token emission schedule is gradually released to minimize inflationary impacts, balancing current ecosystem needs with long-term token stability. Emission and incentive parameters can evolve over time via governance and ecosystem policy; the long-term question is whether incentives translate into durable demand rather than short-term activity spikes.

Incentive Mechanisms for Validators and Participants – Validators are incentivized to maintain network security and process transactions by earning rewards in $KAIA tokens. Staking rewards are available to both validators and general users, ensuring broad network participation. This model motivates active contribution, encouraging validators, developers, and users alike to secure and expand the ecosystem.

Inflation/Deflation Dynamics and Future Sustainability – Like many L1s, Kaia can use a mix of inflation (issuance for security incentives) and deflationary mechanisms such as fee burns. These levers can influence supply over time, but they do not guarantee token value. The practical question for builders and investors is whether real usage grows sustainably enough that demand persists beyond incentives.

The Kaia Blockchain Ecosystem and Web3 Partners in Asia

Kaia’s ecosystem story is unusually partnership-heavy: it blends Web3 primitives (wallets, DeFi rails, NFTs) with corporate distribution and consumer touchpoints across Asia. The value of this ecosystem depends on whether integrations create repeat on-chain behavior rather than one-off activations.

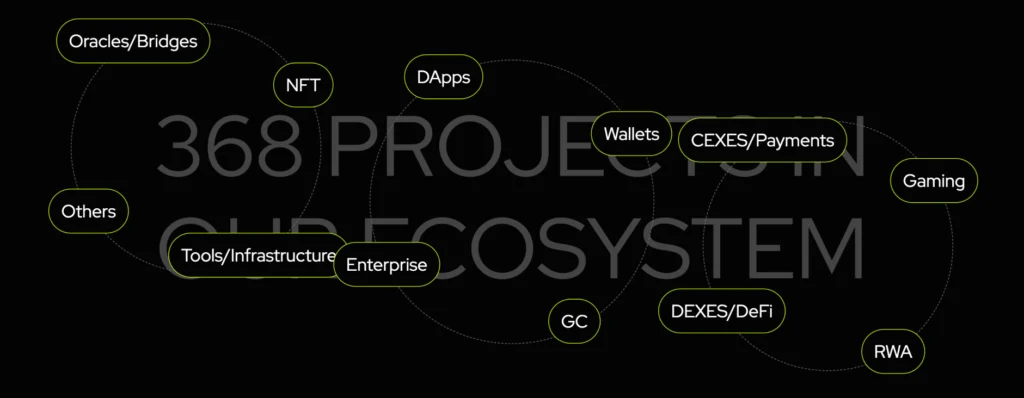

The map below shows breadth, but breadth alone does not imply depth. The 2026 question is which clusters are producing durable usage and liquidity loops that can survive beyond campaign cycles.

Kaia’s ecosystem breadth: major Web3 use cases and strategic partners.

Kaia Chain Use Cases: DeFi, Gaming, NFTs and Real-World Asset Tokenization

Kaia’s use cases are often described as a broad menu: enterprise integrations, consumer mini-apps, and crypto-native categories like DeFi, gaming, and NFTs. In 2026, the question is not whether these categories can exist — it is whether any of them create repeat usage that compounds into liquidity depth and measurable value capture.

This section focuses on the practical conversion layer: how builders and enterprises actually ship on Kaia, and which categories are most likely to translate distribution access into durable on-chain behavior.

How developers leverage Kaia for real applications

Kaia’s strongest “why build here” argument is that distribution can reduce onboarding friction: users encounter wallets, mini-apps, and embedded Web3 features inside familiar Web2 environments. The key test is whether those integrations produce habit loops after incentives cool.

In practice, builders care less about abstract capability and more about whether the chain offers stable tooling, predictable costs, and a real path to retained users. Those factors determine whether developers treat the ecosystem as durable infrastructure or a short-term distribution experiment.

Enterprise integration pathways

SDKs, APIs, and mini-app deployment: A growing portion of Web3 adoption is driven by enterprises seeking integration pathways that do not require deep blockchain expertise. Kaia’s enterprise enablement focuses on reducing onboarding complexity through SDKs, API endpoints, and lightweight methods that mirror familiar Web2 workflows, allowing businesses to experiment without redesigning their architecture.

The mini-app model used across LINE and Kakao demonstrates this approach. Instead of building standalone decentralized applications, enterprises can deploy modular Web3 features into environments users already understand, such as messaging apps or existing customer portals — reducing friction that enterprise teams often cite as a barrier to experimentation.

For enterprises, this model provides flexibility. A business can begin with limited capabilities—such as issuing digital certificates, loyalty rewards, or verifiable receipts—and then expand gradually into more advanced use cases like asset tokenization or on-chain governance. This phased approach allows teams to evaluate performance, security, and user reception before scaling more complex blockchain workflows.

Kaia’s versatile blockchain ecosystem supports a range of innovative applications that showcase its impact across different industries. From decentralized finance (DeFi) to gaming and real-world asset (RWA) management, Kaia enables developers to build applications that harness blockchain’s unique capabilities while reaching broad audiences.

DeFi on Kaia: liquidity, DEX activity, and the conversion test

One of the standout use cases within Kaia’s ecosystem is in DeFi and decentralized exchanges (DEXs). Through secure, scalable infrastructure, Kaia allows DeFi platforms to provide users with seamless trading, lending, and staking opportunities. These applications offer liquidity options and reduced transaction costs, allowing users to participate in decentralized finance with the security and trust enabled by Kaia’s blockchain framework. For context on accountability standards in DeFi, see this analysis.

Case Study – Kaia Wallet (by LINE)

Kaia Wallet, LINE’s blockchain wallet integrated with Kaia’s platform, enables users to participate in DeFi services, including token swaps and staking. By leveraging Kaia’s infrastructure, Kaia Wallet can offer low transaction fees and an integrated experience inside familiar consumer channels. However, Kaia’s broader DeFi liquidity indicators remain relatively modest in public dashboards, so the key question is whether wallets and mini-app distribution can translate into deeper, more durable liquidity over time. Kaia Wallet demonstrates how Kaia’s platform can embed DeFi features into mainstream applications, allowing LINE to expand its financial product surface area.

Gaming and NFTs on Kaia: consumer traction vs incentive-driven spikes

Kaia is also transforming the gaming and NFT space. The platform supports blockchain-based games and NFT marketplaces, where creators can mint, trade, and showcase digital assets. This functionality gives developers the tools to create engaging, asset-driven experiences, fostering digital community growth and user engagement through NFTs.

Case Study – MyMusicTaste

In collaboration with Kaia, MyMusicTaste, a platform allowing fans to support their favorite artists, has launched NFTs that let fans own exclusive digital content and experiences. Using Kaia’s blockchain, MyMusicTaste can tokenize these digital assets and trade them within a marketplace. This use case shows how Kaia’s infrastructure supports NFT marketplaces, creating engagement-driven revenue streams and allowing fans to connect more directly with artists through digital ownership.

Real-world assets on Kaia: where enterprise pilots meet retention reality

In enterprise solutions, Kaia’s blockchain offers unique advantages for real-world asset tokenization and management. Companies can leverage Kaia to integrate physical assets into the blockchain, increasing transparency, security, and access for stakeholders. This application is essential for industries like supply chain management, real estate, and finance, where asset authenticity and traceability are critical. A typical example might include tokenizing ownership rights for supply chain components to improve traceability, although implementations will vary by industry.

Example Workflow: How an Asset Registry Could Migrate to Kaia

To illustrate how Kaia may be used in real-world asset tokenization, consider a hypothetical asset registry seeking to improve transparency and auditability for supply chain components. The registry could begin by assigning each physical item a unique digital representation that is recorded on-chain, enabling stakeholders to verify its origin and lifecycle. This would not replace traditional documentation but could complement it with a tamper-resistant audit trail.

A second layer of functionality may include role-based access for manufacturers, logistics providers, and auditors, allowing each participant to certify or update item status using digital signatures. Smart contracts could automate checks or flag discrepancies, reducing manual reconciliation. Although implementations differ significantly across industries, this workflow highlights how enterprises may use Kaia to enhance trust, reduce administrative friction, and support broader digitization efforts.

Kaia Chain’s Market Approach and How It Compares to Other Layer-1 Blockchains

Comparisons are useful here because Kaia is not competing on a single dimension like raw throughput. It is competing on whether enterprise distribution can translate into the compounding signals that investors and builders use to judge durable ecosystems.

We keep the framing practical: what Kaia is optimized for, where it is structurally strong, and where it may face constraints relative to liquidity-dominant networks.

Kaia vs Ethereum and Solana: A Practical Comparison

Kaia distinguishes itself in the blockchain industry through a focus on accessibility, scalability, and partnerships with established corporations like Kakao and Line. Unlike many blockchain platforms that primarily target crypto-native users, Kaia bridges Web2 and Web3 by offering an ecosystem that appeals to a diverse range of users, from enterprises to everyday individuals. This approach places Kaia in a unique position within the market, combining a streamlined experience design with enterprise-grade infrastructure, which supports a wide range of practical applications in DeFi, gaming, NFTs, and beyond.

For additional context on the regional backdrop that shaped Kaia’s thesis, see our research on Korea’s crypto landscape.

Where Kaia May Face Competitive Constraints

While Kaia offers strong advantages in distribution, user access, and Web2 interoperability, it also operates in a maturing and highly competitive Layer-1 environment. Larger ecosystems such as Ethereum and Solana maintain deeper developer communities, broader tooling ecosystems, and long-established liquidity networks. Developers evaluating Kaia have suggested that tooling maturity, documentation depth, and third-party integrations remain areas where additional investment could accelerate adoption.

Another consideration is the pace of innovation among competitors. Layer-1 and Layer-2 ecosystems continue to evolve rapidly, introducing upgrades that improve throughput, reduce fees, or expand interoperability. Industry analysts have indicated that Kaia’s long-term competitiveness may depend on how effectively it differentiates through ease of onboarding, enterprise alignment, and practical integration models rather than raw throughput alone. For broader context on risk considerations, see our research on blockchain risk management.

Strengths and Weaknesses – Kaia excels in accessibility and partnerships, particularly with Kakao and Line, giving it a large, built-in user base. However, compared to Ethereum’s well-established developer community, Kaia’s ecosystem is still growing and may face challenges expanding developer engagement. Kaia’s interoperability focus positions it well against Polkadot, which also emphasizes cross-chain functionality, but Kaia differentiates by integrating seamlessly with Web2 and Web3, a key advantage.

Market Opportunities and Threats – Kaia has significant opportunities within Asia’s growing digital economy, where blockchain adoption is accelerating. Its partnerships also provide a strong foothold in the enterprise sector. However, the blockchain space is highly competitive, and innovations from Solana or Ethereum’s layer-2 solutions could pose challenges to Kaia’s market share.

Growth Potential – Kaia’s low-friction, high‑throughput approach gives it high growth potential, especially in regions where accessible blockchain solutions are in demand. With its unique strengths and strategic partnerships, Kaia is positioned to become a leading player within the Web3 ecosystem, particularly among non-technical users and large-scale enterprises looking to enter blockchain.

Kaia Chain Roadmap: Past Milestones, Present Development and Future Plans

Roadmaps matter most when they explain how a chain intends to close its conversion gap: what gets prioritized, what gets shipped, and what metrics will change if the strategy is working. In 2026, Kaia’s challenge is less about feature completeness and more about proving compounding behavior.

The timeline below is useful context, but the key lens is whether roadmap execution strengthens developer pull, liquidity depth, and retention loops — not only partnerships and integrations.

Developer ecosystem maturity

Developer ecosystem maturity is the practical bridge between “distribution access” and real compounding. The more a chain feels like neutral, reliable infrastructure, the more likely independent teams are to keep shipping even when incentives cool.

This is why roadmaps should be read alongside public adoption signals: if builders and liquidity do not stick, the roadmap is not converting potential into gravity.

Past milestones: what shipped vs what compounded

Kaia Chain was created through the merger of two established projects, Klaytn and Finschia, combining their experience into a single Layer 1 blockchain designed for Web3 in Asia. Following this Klaytn and Finschia merge into Kaia Chain, the network rapidly formalised strategic partnerships with Kakao and Line to integrate blockchain technology into Web2 environments. After launch, Kaia introduced the $KAIA token, developed a user-friendly staking mechanism, and rolled out its smart contract framework, enabling developers to deploy decentralized applications with reduced operational friction.

Present development: priorities that could close the conversion gap

Currently, Kaia is focused on expanding developer tools and interoperability features, allowing more seamless integration with other blockchain protocols. This phase prioritises elevating the developer experience, expanding enterprise-grade capabilities, and strengthening security protocols to support high-value transactions. Ongoing development updates and structured community consultations have emerged as core components of Kaia’s strategic approach, with the team actively engaging developers and users for feedback and improvement ideas.

Developer Funding, Grant Programs, and Ecosystem Support

A key factor in any blockchain ecosystem’s growth is the level of structured support available to developers and early-stage teams. Although Kaia has not publicly released detailed grant frameworks comparable to those of the largest Layer-1 ecosystems, community discussions and ecosystem updates suggest increasing interest in creating more formalised support mechanisms. These may include bounties for tooling contributions, ecosystem accelerators, and funding pools designed to encourage third-party innovation.

Broader developer programs—such as hackathons, educational partnerships, or mentorship networks—can also play a role in shaping ecosystem maturity. Many blockchain ecosystems have benefited from coordinated outreach efforts that help onboard new builders and create a pipeline of projects. Indicators from Kaia’s community channels suggest growing demand for such structured programs, especially among teams building DeFi infrastructure, gaming ecosystems, and NFT-driven consumer applications.

Future milestones: what would change the 2026 outlook

Looking ahead, Kaia aims to build on its existing infrastructure by introducing advanced DeFi functionality and real-world asset tokenization options, laying the groundwork for wider industry‑level deployment. Upcoming plans include further integration with Web2 technologies and exploring cross-chain bridges to extend interoperability. Kaia’s long-term goal is to support high transaction volumes while ensuring low costs and robust security, solidifying its role as a scalable, user-friendly Layer-1 blockchain.

Community and long-term vision: governance, incentives, and retention loops

Kaia’s development relies heavily on community involvement, with governance participation and regular updates encouraging user engagement and shared decision-making. The platform’s long-term vision is to establish itself as the premier blockchain for enterprises and non-technical users alike, providing a scalable, secure, and accessible ecosystem that bridges Web2 and Web3 seamlessly.

Risks and Challenges for Kaia Chain

In 2026, the primary risk for Kaia is no longer whether it can ship technology — it is whether the ecosystem can convert distribution into compounding behavior. The risks below are framed around that conversion gap and the signals highlighted in the metrics snapshot.

Conversion risk: acquisition without durable retention

Kaia’s thesis depends on mainstream onboarding through LINE and Kakao. The risk is that onboarding creates bursts of activity without long‑term repeat usage. In practice, durable ecosystems tend to show compounding loops: users returning, liquidity staying, and builders shipping independent apps that attract new users organically. Without stronger retention and repeat economic activity, Kaia can remain “high potential” while still failing to build ecosystem gravity.

Liquidity and value-capture risk: shallow DeFi footprint

Relative to the scale implied by Kaia’s distribution narrative, public liquidity signals (TVL, DEX volume, fees/revenue) remain modest. This matters because liquidity depth is a key prerequisite for many on‑chain business models: DeFi, trading, stablecoin settlement, and consumer apps that depend on liquid markets. If liquidity remains thin, builders often treat the chain as opportunistic rather than durable, which slows compounding.

Partner dependency risk: corporate distribution is not neutral infrastructure

Kaia’s differentiator (enterprise distribution) is also a dependency. Shifts in platform strategy, product priorities, or compliance posture by key partners can affect onboarding funnels and user flows. This is structurally different from ecosystems where growth is primarily driven by open, permissionless distribution channels and independent developer communities.

Decentralization and governance credibility risk

Public decentralization signals suggest Kaia may face a credibility gap with some builders and capital providers. When validator diversity and governance decentralization are perceived as weak, ecosystem participants may discount the chain’s durability and neutrality — especially for applications that require long-horizon settlement assurances.

Incentive decay risk: short-term activity that fails to compound

Incentives can bootstrap attention, but they can also create “mercenary” usage that disappears when rewards fade. If Kaia’s growth relies heavily on campaigns rather than repeat-product value, the ecosystem can experience periodic spikes without compounding. This dynamic often produces the appearance of momentum without the underlying retention needed to sustain it.

Regulatory and compliance risk across key Asian markets

Kaia’s enterprise strategy increases exposure to regulatory constraints because distribution partners operate in tightly regulated consumer environments. Shifts in digital-asset rules, stablecoin frameworks, licensing expectations, or consumer protection policy can shape what integrations are feasible and how quickly they can scale. Regulatory friction may also influence which use cases (payments, RWAs, DeFi) are strategically viable.

Interoperability risk: bridge security and cross-chain complexity

If Kaia’s roadmap emphasizes cross-chain connectivity, bridge security becomes a critical risk area. Historically, the wider industry has seen significant losses from bridge exploits and operational failures. Kaia’s long-term credibility depends on conservative security practices, clear incident response, and careful selection of interoperability pathways.

Conclusions: Is Kaia Chain Ready to Onboard Web3?

Kaia’s original thesis remains one of the strongest distribution narratives in Web3: combine enterprise-grade Layer‑1 infrastructure with Web2 reach (LINE + Kakao) and convert mainstream onboarding into sustained on-chain behavior. Two years later, the platform still looks technically capable — but the clearest public “ecosystem gravity” signals (liquidity depth, fee generation, and durable usage) remain small relative to what the narrative would imply.

That doesn’t mean Kaia is finished. It means the next phase must be measured in compounding evidence: retention, liquidity, and independent developer pull that persists even when incentives cool.

The point-of-no-return risk: strong tech persists, but ecosystem gravity never arrives.

Conclusion: Kaia’s adoption thesis depends on distribution, developer experience, and ecosystem depth.

Kaia’s original thesis was unusually strong on paper: combine enterprise‑grade Layer‑1 infrastructure with Web2 distribution (LINE + Kakao) and make onboarding so frictionless that adoption compounds. Two years later, the platform still appears technically capable — but the public signals most associated with compounding ecosystems (liquidity depth, sustained transactional velocity, and meaningful fee generation) remain small relative to the scale implied by the distribution narrative.

This creates a strategic fork. Kaia can still win if it identifies a breakout wedge (for example: stablecoin settlement, consumer mini‑apps with repeat usage, or a specific vertical like gaming) and proves durable retention beyond incentive spikes. But without a clearer “next thesis” — and measurable execution that investors and builders can track — the ecosystem risks drifting toward a point of no return: a stage where the market stops waiting for conversion to arrive and the chain becomes technically sound infrastructure with limited independent gravity.

Three scenarios to watch (2026–2027):

- Turnaround (thesis conversion): stablecoins, TVL, and real fees rise steadily; independent apps emerge that users seek out; developer pull increases beyond partner channels.

- Sideways (distribution without gravity): periodic spikes from campaigns and launches, but little compounding; capital and builders remain opportunistic.

- Slow stagnation (the “Kadena risk”): strong tech and community persistence, but diminishing relevance as liquidity and mindshare consolidate elsewhere.

If Kaia wants to avoid the stagnation path, the simplest near‑term goal is not “more partnerships” — it is proof of compounding: retention, liquidity depth, and value capture that grows even when incentives cool. That is the standard the market increasingly applies in 2026, precisely because the “tide lifts all boats” era has weakened.

Kaia project overview official project site.

If you’re operating on Kaia (or considering it), you can use risk-management badges to anchor governance and risk‑management claims on-chain, and verify certifications with VaaSBlock.

Check badge status in the verification registry to see how teams demonstrate governance, transparency, and risk‑management practices.

AI and Human Collaboration – Exploration of how AI systems shape human decision-making and digital trust frameworks.

About This Analysis

This article is compiled by VaaSBlock’s research team using publicly available documentation, ecosystem reports, developer commentary, and third-party market analysis. It reflects the state of the Kaia ecosystem as reported at the time of writing and is intended as an informational editorial assessment rather than promotional content. Readers are encouraged to consult primary documentation, regulatory guidance, and independent security audits when conducting their own due diligence.

Kaia Chain FAQs (2026)

These FAQs summarize the core questions readers ask when evaluating Kaia two years after launch — especially around conversion, retention, and the risk of slow stagnation. They are written to match common search intent (Kaia, Klaytn, Finschia, LINE, Kakao) while staying anchored to measurable signals.

If you only read one thing, focus on the conversion lens: distribution is a funnel, not a flywheel. The questions below explain what would need to change for Kaia to demonstrate compounding ecosystem gravity.

What is Kaia Chain?

Kaia Chain is a Layer‑1 blockchain formed through the merger of Klaytn and Finschia. Its core positioning is “Web2 → Web3 onboarding” via enterprise distribution channels, especially LINE and Kakao. The network supports smart contracts, staking, and dApp development, with a focus on consumer-friendly UX and regional adoption in Asia.

What was Kaia’s original thesis after launch?

The original thesis was that Web2 distribution (LINE + Kakao) plus a low-friction Layer‑1 could convert mainstream users into sustained on-chain activity that compounds over time. In practice, that requires retention loops (repeat usage), liquidity depth (capital staying), and developer pull (independent apps attracting users without being pushed through partner channels).

Is Kaia “working” in 2026 — or struggling?

Kaia appears technically capable and maintains visible ecosystem activity, but the simplest way to describe the 2026 reality is: Kaia may be succeeding at distribution while still struggling at compounding. Several public “ecosystem gravity” proxies (DeFi liquidity depth, fee generation, and sustained transactional velocity) remain relatively small compared to what mass-onboarding narratives typically imply. That gap is the core question this article explores: access versus conversion.

How does Kaia compare to TON as a messaging-distribution strategy?

TON is the closest analogue because Telegram provides a similarly powerful consumer distribution channel. The comparison is useful because it highlights the conversion problem: distribution can drive onboarding, but compounding requires a durable economic base (stablecoins, liquidity, and third‑party builders treating the chain as long‑horizon infrastructure). In the public snapshots referenced here, TON shows a larger stablecoin base and stronger decentralization signals — which helps liquidity providers and builders treat the chain as more durable — while Kaia’s liquidity and fee signals remain smaller.

How does Kaia compare to Solana?

Solana is included as a benchmark for what compounding ecosystem gravity looks like in practice: deep liquidity, high transactional velocity, and material fee generation. Kaia’s differentiation is enterprise distribution and low-friction onboarding rather than crypto-native liquidity dominance. The strategic challenge is proving that distribution converts into those same compounding signals over time.

What is a “point of no return” for an L1 ecosystem?

In this context, “point of no return” refers to a stage where the market stops waiting for a chain’s adoption thesis to arrive. The chain may remain technically sound, but liquidity, builders, and mindshare consolidate elsewhere. The outcome is usually slow stagnation rather than a sudden collapse — often compared to technically strong ecosystems that never achieved durable gravity.

What metrics would indicate a Kaia turnaround?

Turnaround signals are the ones that typically compound: sustained stablecoin growth, deeper and diversified TVL (not a single incentive pool), consistently higher DEX volumes, and rising fees/revenue that track real activity. On the ecosystem side, it also looks like independent apps gaining users without relying solely on distribution channels, plus governance credibility improvements that reduce dependency concerns.

How does the $KAIA token work?

$KAIA is Kaia’s native token used for transaction fees, staking (network security), and governance. Like most L1 tokens, the long-term question is value capture: whether real usage generates sustainable demand that persists beyond incentives. The token’s role matters most when it is tied to repeat economic activity rather than one-off onboarding spikes.

$KAIA: native token used for fees, staking, and governance.

Is Kaia Chain energy efficient?

Yes. Kaia uses a proof-of-stake model, which is typically far more energy efficient than proof-of-work networks. Validators stake $KAIA to help secure the chain and earn rewards, enabling lower energy usage per transaction than PoW designs.

What risks should teams consider before building on Kaia?

Key risks in 2026 relate to conversion and durability: whether user acquisition converts into retention, whether liquidity depth is sufficient for the app category you’re building, the extent of partner dependency, governance credibility/decentralization signals, incentive decay (short-term spikes), and regulatory constraints in key Asian markets.

What is the connection between Kaia and VaaSBlock’s RMA badges?

VaaSBlock mints Risk Management Authentication (RMA) badges on Kaia to anchor governance and risk-management claims on-chain. This supports verification workflows for stakeholders who want evidence of practices like transparency, governance processes, and security posture — independent of marketing claims. See risk-management badges and the verification registry for how badges are checked.

Is Kaia Chain the same as Klaytn?

No. Kaia was formed through the merger of Klaytn (Kakao ecosystem) and Finschia (LINE ecosystem). Many users still search for “Klaytn” when researching Kaia, but Kaia represents a new combined network strategy and ecosystem direction rather than a simple rename.

What is Finschia and why does it matter for Kaia?

Finschia was LINE’s Web3 blockchain initiative. Its merger into Kaia matters because it ties Kaia’s distribution thesis directly to LINE’s consumer footprint. Strategically, this is one of Kaia’s biggest differentiators — but it also increases the importance of proving that distribution converts into durable on-chain activity.

What is Kaia Wallet and how does it connect to LINE?

Kaia Wallet is LINE’s blockchain wallet product integrated with Kaia’s ecosystem. It’s important because it represents the practical “conversion layer” for the distribution thesis: wallets and mini-apps are often where onboarding becomes real usage (payments, swaps, staking, and consumer dApp interaction). The open question is whether that distribution translates into compounding liquidity and repeat activity at the chain level.

Is Kaia Chain centralized?

Kaia uses proof-of-stake, but decentralization is not binary — it is a spectrum shaped by validator diversity and governance. In the public snapshot referenced in this article, Kaia’s decentralization indicators look meaningfully weaker than TON and Solana (for example, a low validator count and a Nakamoto coefficient of 1). That doesn’t automatically make Kaia “unsafe,” but it can reduce perceived neutrality and long-horizon settlement confidence for some builders and capital providers.

Why hasn’t Kaia’s distribution thesis converted into ecosystem gravity yet?

Because distribution is a funnel, not a flywheel. Messaging channels can create onboarding spikes, but ecosystems only compound when users keep transacting after incentives cool and when capital stays liquid on-chain (stablecoins, TVL, active markets). In Kaia’s public metrics snapshot, the economic base is still small relative to the implied distribution opportunity — suggesting that access exists, but the flywheel (retention + liquidity + independent apps) has not locked in at scale.

What is Kaia’s most realistic breakout wedge in 2026–2027?

If Kaia breaks out, it likely won’t be “general DeFi” — it will be a wedge that converts LINE/Kakao distribution into repeat usage. The highest-probability wedge is stablecoin settlement + consumer payments (because it can compound with real-world habit loops). Second is a mini-app economy where users return weekly without being paid to do so. Gaming remains possible, but it tends to be incentive-heavy and cyclical unless a flagship title sustains demand.

Should developers build on Kaia in 2026?

Build on Kaia if distribution is your edge: consumer apps, mini-app experiences, brand integrations, and flows that benefit from LINE/Kakao reach. Be cautious if your product depends on deep liquidity (serious DeFi, liquid markets, large stablecoin rails) because Kaia’s public liquidity footprint is still modest — and liquidity is the hardest thing to “promise” into existence. The practical approach is to validate the distribution funnel early, then watch whether the ecosystem metrics start compounding in your category.

What metrics should investors track monthly for Kaia?

The most useful public metrics are: stablecoin market cap (settlement base), TVL (liquidity depth), DEX volume (usage velocity), fees/revenue (value capture), and decentralization signals (validator diversity, Nakamoto coefficient). Tracking these monthly helps separate short-term spikes from real compounding progress.

Why is KAIA down compared to the original expectations?

KAIA’s underperformance appears driven less by “market cycle” alone and more by the gap between launch expectations and durable economic reality. In 2026, the most important signals are retention and ecosystem gravity: whether onboarding converts into repeat usage, whether liquidity stays, and whether independent developers keep building without heavy subsidies. If those compounding loops remain weak, token value tends to face persistent pressure from incentives, emissions, and narrative fatigue.

Is Kaia at risk of becoming irrelevant?

Kaia is not dead, but the risk of long-run irrelevance is real if the project cannot convert its distribution advantage into durable compounding behavior. Many technically strong chains stagnate when they fail to produce a breakout wedge (payments, mini-app economy, or a flagship consumer category) and when activity remains campaign-driven. The 2026–2027 window matters: if retention and liquidity depth do not improve meaningfully, the market may stop waiting for the thesis to arrive.

References

DefiLlama Chain Dashboards – TVL, stablecoins, DEX volume, fees, and revenue snapshots for Kaia, TON, and Solana. Sources: https://defillama.com/chain/kaia, https://defillama.com/chain/ton, https://defillama.com/chain/solana.

Chainspect Chain Analytics – Real-time TPS, decentralization metrics (validators, Nakamoto coefficient), average fees, and total transactions for Kaia, TON, and Solana. Sources: https://chainspect.app/chain/kaia, https://chainspect.app/chain/ton, https://chainspect.app/chain/solana.

Kaia Chain White Paper – Detailed overview of Kaia’s blockchain architecture, consensus mechanism, and tokenomics. Source: https://docs.kaia.io/kaiatech/kaia-white-paper/

Kaia Ecosystem Overview – Insight into Kaia’s ecosystem, partnerships, and components. Source: https://www.kaia.io/ecosystem.

Kaia on CoinMarketCap – Overview of Kaia’s token model and position in the market post-Klaytn and Finschia merger. Source: https://coinmarketcap.com

Kaia’s Formation Through Klaytn and Finschia – Article on Kaia’s establishment, powered by Kakao and LINE to create a large-scale Web3 ecosystem. Available at: https://www.koreatimes.co.kr

Kaia’s Entry in the Philippines – Kaia’s strategic launch in the Philippines and partnership initiatives. Available at: https://www.metropoler.net

Kakao’s Blockchain Investments – Coverage of Kakao’s efforts to broaden blockchain adoption in Asia through Klaytn and Kaia. Source: https://www.koreaherald.com

LINE’s Web3 Expansion and Finschia Foundation – Outline of LINE’s role in advancing Kaia as a Web3 platform. Available at: https://linecorp.com

Blockchain Development Trends in Asia – Analysis of blockchain growth across Asia’s finance and industry sectors. Available at: https://asiatimes.com

Web3 in Korea and Asia – Analysis of web3 ecosystem growth across Asia. /ncng/tiger-research-daniel-kim/

RWA Tokenization Growth – Report on the use of blockchain for real-world asset tokenization, with a focus on enterprise applications. Source: https://www.blockchainresearchinstitute.org

Blockchain and RWA Market Trends – A market overview on the blockchain-driven tokenization of physical assets. Available at: https://www.coindesk.com

Klaytn’s Blockchain Strategy – Insight into Kakao’s strategy for Klaytn’s expansion and its impact on Asia’s digital economy. Available at: https://www.klaytn.foundation

LINE’s Blockchain Initiatives – LINE’s push into Web3 with Kaia, focusing on cross-platform integration across Asia. Available at: https://medium.com/line

Web3 and Metaverse Applications in Asia – Analysis of Web3 and blockchain impacts on Asia’s entertainment and social platforms. Available at: https://www.forbes.com

Kaia’s Market Position in Web3 – Discussion of Kaia’s approach to making Web3 accessible across Asia. Available at: https://medium.com/kaiachain

RWA Tokenization Trends – Overview of how blockchain is transforming asset tokenization in industries such as real estate. Available at: https://www.techcrunch.com

Web3 Expansion in Asia – Report on Asian tech companies like Kakao and LINE leading Web3 adoption. Available at: https://asia.nikkei.com