TL;DR

Microsoft is losing “default status” across parts of its core business — not because it suddenly became incompetent, but because switching costs are collapsing. Windows is becoming optional, Office is being re-evaluated, and Xbox is testing price tolerance. The upside is Azure: if Microsoft becomes the neutral infrastructure layer for global AI deployment — and moves fast enough to matter — 2026 can still be a survival year. The cost is speed: more restructuring, flatter org charts, and a shift from annual planning to six-month execution.

Why the next 12 months depend on Azure utilisation, sovereign cloud, and organisational speed.

Disclosure: This is editorial analysis based on publicly available reporting, company filings, and product documentation. A consolidated list of references appears in Sources & Notes at the end.

Microsoft is losing default status across parts of its core business — not because it suddenly became incompetent, but because switching costs are collapsing. People no longer need Windows to boot, Office to write, or Xbox to play. Linux is viable. Open-source AI is accelerating. Cloud competition is cheaper and faster. And the macro backdrop is shifting in ways that reward neutrality and local deployment. The stock is no longer priced like a monopoly — it’s priced like an infrastructure bet that still has to prove itself.

Our case is simple: legacy Microsoft is weakening fast, but a global, politically-neutral Azure could still turn 2026 into a survival year, if the company moves faster and cuts deeper than it’s ever been willing to.

In this report, we break down:

- Why capex flattening changes the stock story

- Where Microsoft’s legacy products are losing default status (Windows, Microsoft 365, Xbox, Azure developer trust)

- Why Azure’s “neutral cloud” positioning is becoming a procurement advantage

- What currency diversification and sovereign requirements mean for global AI buying decisions

- Our scenario-based Microsoft stock forecast for 2026

Update note (January 2026): This analysis reflects public information available as of early January 2026. We’ll update the piece as new earnings commentary, capex guidance, and AI platform announcements emerge.

January 2026 updates: Blind layoff rumour context · Why “Azure news” search demand matters · The efficiency arms race and Azure’s positioning

The remaining upside is not in legacy recovery. It’s in Microsoft becoming the neutral infrastructure layer for global AI deployment — and doing it fast enough to matter. That means hosting multiple model families, expanding into regions like Indonesia, and staying disciplined about politics while competitors turn AI into a national project.

The catch is cost and tempo. Microsoft will need more restructuring, fewer layers of management, and a six-month execution rhythm — because the AI cycle no longer waits for annual planning.

If Microsoft pays that cost, it can still compound. If it doesn’t, it becomes a well-run relic. Here’s the breakdown.

CapEx Plateau: A Signal, Not a Number

Capex plateau is a signal, not a number. FY25 capital spending was brutal — roughly $55–65B depending on how you count leases and build-outs. That’s not a flex. It’s Microsoft pouring concrete to keep up with AI demand. Depending on the metric, the numbers look different: “capital expenditures” in the cash-flow statement (property and equipment additions) captures only owned infrastructure, while adding finance leases and long-term cloud commitments pushes the all-in figure higher. The variance matters: some headlines cited $55B, others $65B, and both were technically correct. The difference is whether you include leased sites and multi‑year obligations, not just what sits on the balance sheet this quarter.

FY26 guidance and CFO commentary point to the next phase: slower growth, tighter pacing, fewer new mega-sites. The signal isn’t the dollar figure — it’s the flattening of capex after years of relentless increases. When Microsoft’s CFO says “slower growth,” it means the first wave of AI infrastructure is mostly built. The market’s focus shifts: from expansion at any cost to utilisation, margin expansion, and proof that these new datacenters won’t become stranded assets. In short, the era of “just build more” is over; now it’s about sweating those assets and showing real returns.

That’s why the stock can still rise even while the legacy mix looks stressed. Microsoft finished 2025 up around 16% despite constant headlines about layoffs, product fatigue, and Xbox stumbles. Investors didn’t buy the legacy story — they bought the idea that Azure can turn capex into recurring revenue before the rest of the market realises the party has moved offshore.

To be clear, the capex story changed quarter by quarter. Early FY25 was about acceleration — more AI demand, more capacity, more leased sites, more GPUs. By the back half of the year, the tone shifted. Analysts started flagging lease cancellations and paused build-outs, and Microsoft began talking less about “more” and more about “efficient” — shifting capacity to where power, cooling, and local regulation actually make deployments possible.

And this is why we’re careful with single headline numbers. Microsoft’s cash‑flow statement shows “additions to property and equipment” at $64.6B for FY25 — but that’s only the owned footprint. When you add finance leases and long-term commitments, the real infrastructure burden is higher. The market isn’t reacting to the number — it’s reacting to the inflection: the moment capex stops compounding and investors start demanding a return. 2026 is the year Microsoft has to prove utilisation — and prove that this build‑out becomes durable cash flow, not stranded capacity.

CapEx is no longer a flex — it’s the bill.

The capex question is now secondary. The bigger issue is whether Microsoft’s legacy defaults can hold long enough for Azure to convert global demand into utilisation.

Four Legacy Defaults Under Pressure

The risk isn’t one product failing — it’s multiple defaults weakening at once.

Microsoft’s core risk in 2026 isn’t that any single product collapses — it’s that multiple defaults weaken at once. Switching costs are shrinking. Free alternatives are improving. And choices that used to be automatic are now being evaluated like any other vendor decision.

Windows

From default to optional — The Windows story in 2026 isn’t mass abandonment — it’s that more users are willing to question the default. That’s what happens when an OS becomes an ad surface and the upgrade cycle feels forced. StatCounter’s desktop data shows Windows 11 has overtaken Windows 10 globally, but the gap hasn’t widened the way Microsoft expected — millions are still sitting on Windows 10, delaying upgrades, or waiting for the “next stable version.” Among gamers, Steam’s hardware survey shows Windows 11 is now dominant, while Linux remains small — but stubborn and slowly improving. Steam’s own monthly data repeatedly shows Linux/SteamOS hovering around the low single digits. That’s not “exodus.” But it is momentum, and it matters.

The Steam Deck is the wedge. It normalises a non-Windows gaming experience for millions of users who never would have touched Linux otherwise. Pair that with rising “how to install Linux” search interest, more mainstream content recommending Linux for specific use cases, and recurring “Windows bloat” backlash cycles — and you get the real takeaway: not migration, but optionality. And once Windows becomes optional, it loses its monopoly psychological power.

None of this implies Windows is about to lose its majority share. It implies something subtler: the OS is no longer untouchable. And when Windows becomes a choice instead of a reflex, Microsoft’s pricing power and platform gravity weaken at the margin.

Takeaway: Windows doesn’t need an exodus to be a risk — it only needs a world where staying becomes a choice instead of a reflex.

Microsoft 365

Price defence vs value delivery — This is where Microsoft is steadily testing customer patience. Microsoft 365 news headlines through 2025 were full of pricing tweaks, Copilot bundling, licensing reshuffles, and feature drops that feel designed to defend ARPU, not delight users. The product still works — that isn’t the question. The question is whether the price-to-value equation still holds. If your “AI upgrade” doesn’t reliably save time, customers do the math. Google Workspace is “good enough.” Notion keeps getting better. LibreOffice and other open options don’t have to beat Microsoft feature-for-feature — they only need to be viable.

Microsoft’s own behaviour suggests pressure: more bundling, more segmentation, and more “AI value” messaging to justify higher pricing. That is the pattern you see when retention is being actively defended — even if the product still works. Even single‑digit pressure on the installed base is enough to change the story when alternatives are free, improving, and culturally acceptable.

Takeaway: Even modest pressure on Microsoft 365 matters because the alternatives don’t have to be perfect — they only have to be viable.

Xbox

Subscription backlash as a strategic risk — The Game Pass price increase backlash wasn’t just noise — it signaled that the value narrative is under pressure. Microsoft didn’t raise prices modestly; it redesigned tiers, moved the goalposts, and effectively told players: if you want day-one releases, you’re paying premium. Reuters reported the headline move: a 50% increase for Game Pass Ultimate — from $19.99 to $29.99 — with Microsoft justifying it through day-one releases and expanded cloud features. That framing is smart. The timing is risky.

Why? Because Xbox is trying to monetise a user base that is already sensitive to strategic uncertainty. When your hardware position is weak, you can’t afford to make your best retention engine feel like a tax. Gaming press reporting and forum chatter went further — suggesting a material subscriber dip after the hike, including an unverified claim that roughly 12 million subscribers vanished. Microsoft has not validated that figure, and it should be treated as speculation until confirmed. But the broader point stands: Xbox is now testing price tolerance at the same time it must prove its long-term content cadence. Xbox Developer Direct 2026 matters because Microsoft needs a content story strong enough to justify subscription pricing — not just another repackage of the same franchises.

Takeaway: Subscriptions only tolerate price hikes when the content slate feels undeniable — and Microsoft is about to be tested on that.

Azure

Developer trust as hidden churn — Azure isn’t weakening at scale, but its developer reputation has always been uneven. The friction isn’t a lack of features; it’s platform sprawl, churn, and deprecations that force teams to refactor with limited upside. This isn’t a moral argument — it’s an engineering cost argument. The quiet retirement of free tooling is a useful example: IntelliCode has been deprecated, and Microsoft’s own guidance increasingly points developers toward Copilot-based workflows. That is a rational revenue strategy. It is also a signal: the free era is shrinking, and the platform is becoming more tightly monetised.

The IntelliCode deprecation is a micro-example of the broader pattern: “free” becomes “trial,” “tooling” becomes “SKU,” and developer goodwill becomes a line item. Azure can still win procurement battles in the enterprise — but in developer circles, trust is harder to rebuild than infrastructure.

Takeaway: Azure can win enterprise procurement, but developer sentiment is the hidden variable that determines long-term platform gravity.

Put those four together and the point is simple: the legacy businesses aren’t dead, but they’re losing default status. And once customers believe switching is plausible, stock market sentiment changes — because investors stop treating these lines as guaranteed annuities and start pricing them like competitive businesses.

Keyword capture: This is why Microsoft stock market sentiment heading into 2026 is increasingly tied to Azure utilisation and global AI demand, not legacy dominance.

In short: Microsoft is still large, still profitable, and still deeply embedded — but its legacy defaults are no longer automatic. In 2026, the market will price the difference.

The One Escape Hatch: Neutral Cloud in a Politicized World

Microsoft’s escape hatch is geographic — and political.

AI is political now — not because executives want it to be, but because governments and regulators have made it strategic infrastructure. Once models became tied to data residency, export controls, election risk, and sovereign cloud requirements, the buying conversation shifted from features to jurisdiction. Every serious buyer is now asking the same questions: where does the data live, who can subpoena it, and what happens if Washington or Beijing changes the rules overnight?

This is why Microsoft AI news in January 2026 is worth watching closely: the language is shifting toward operational deployment, governance, and compliance — not just model demos.

Update: Why this page started ranking for “Azure news” queries

Since publication, this article has shown up for a surprising number of “Azure news” searches. That’s not a vanity metric — it’s a proxy for where attention has moved. In early 2026, the center of gravity is not “which model is coolest,” but “which cloud is actually shipping.” Azure’s own update cadence makes the point: the public feed is a steady drumbeat of production changes across storage, security, DevOps, databases, and AI-adjacent services. That is the kind of operational momentum enterprises reward — because it reduces platform risk, not just demo risk.

Takeaway: when buyers search “Azure news,” they’re often searching for reliability signals — patches, governance moves, previews graduating to GA — not hype.

The efficiency arms race: “intelligence density” is the new battleground

The next phase of AI is not only bigger models — it’s cheaper intelligence. That’s why you’re seeing public talk shift toward efficiency and “intelligence density”: how much useful reasoning you can deliver per unit of compute, memory, and energy. For Microsoft, this is where Azure’s positioning becomes more strategic than the model-of-the-week cycle. If enterprises are going to run multiple model families in production, they will care less about rhetoric and more about predictable cost-per-token, deployment controls, and the ability to swap models without rebuilding the stack.

A concrete example of this shift landed mid‑January 2026, when Elon Musk highlighted a Tesla AI technique (described in recent patent coverage) aimed at delivering near‑32‑bit accuracy while running key operations on cheaper 8‑bit hardware — the underlying point being the same: efficiency wins when it compresses cost without collapsing quality. For Azure, the strategic parallel is obvious: Microsoft doesn’t need to invent the trick — it needs to productise the economics. Quantisation, mixed precision, batching, and serving optimisation already exist across modern GPU stacks; the cloud that standardises them safely — and exposes them as knobs enterprises can trust — will lower the true cost-per-token of deployment.

Azure AI Foundry’s “model supermarket” approach fits that direction. Bringing frontier models like xAI’s Grok into Foundry is not only about capability; it’s about giving enterprises choice under a governance wrapper, so efficiency improvements (precision, serving, batching, hardware) can be captured at the platform layer rather than fought one vendor at a time.

Takeaway: in 2026, the neutral cloud doesn’t win because it has “the best model.” It wins because it can host the best models, govern them, and drive down the unit economics of deployment.

This is Microsoft’s most credible escape hatch. While other AI players are openly aligned with national agendas — or perceived to be — Microsoft has built for procurement reality: compliance, auditability, and choice. In a market that is increasingly sensitive to headline risk, that “boring” posture reads as neutrality — and neutrality is becoming a buying criterion.

The proof is in the platform strategy. A lot of Satya Nadella Microsoft announcement messaging over the last year has reinforced a shift toward “platform + governance” rather than consumer spectacle. Azure AI Foundry is positioned as a model supermarket — not a single partnership. OpenAI still matters, but Microsoft is also packaging models from other major providers, including Anthropic, Meta, Mistral, and xAI’s Grok series — plus controversial entrants like DeepSeek.

That matters because serious customers don’t want to bet their business on one model vendor. They want leverage and fallback options, with standardised deployment, compliance controls, and predictable SLAs regardless of which model wins.

Microsoft’s Foundry and sovereign-cloud messaging increasingly reads like a procurement playbook: choice, control, auditability — not a consumer AI hype cycle.

Then there’s sovereignty. Microsoft has expanded sovereign cloud products and EU data boundary commitments designed to keep customer data inside jurisdictional borders and give governments more control over operations, personnel, and encryption. You don’t invest in that unless you’re already seeing demand shift from “best model” to “deployable model.”

You can already see this strategy playing out in concrete deployments. In Germany, Microsoft-backed sovereign cloud arrangements are being built specifically for the public sector, including a Delos Cloud platform designed to meet German government requirements. In Saudi Arabia, Aramco Digital has partnered with Microsoft (alongside Armada) on industrial distributed cloud infrastructure intended to run AI workloads closer to industrial sites — a sign that “AI cloud” is becoming regional and edge-native, not only hyperscale. And in Southeast Asia, Microsoft’s Indonesia Central region is a real-world example of the bet: local capacity, local compliance, and local procurement realities. India is moving in the same direction through a growing network of infrastructure and AI partnerships — but the more important point is the procurement pattern, not any single announcement. These are procurement decisions, not hype headlines.

Verified proof points:

- Germany: Microsoft confirmed sovereign cloud arrangements including Delos Cloud for regulated public-sector buyers.

- Saudi Arabia: Aramco Digital, Armada, and Microsoft announced an industrial distributed cloud to support real-world AI workloads.

- Indonesia: Microsoft officially opened the Indonesia Central cloud region as part of its long-term local investment strategy.

The obvious counterargument is that Microsoft has survived platform shifts before: Windows and Office still print cash, enterprise switching remains slow, and Azure is still growing. What has changed is not Microsoft’s size — it’s the number of buyers who now treat AI as regulated infrastructure. That’s all true. The difference in 2026 is tempo — procurement cycles may be slow, but model cycles are not. The companies that win aren’t just the ones with distribution; they’re the ones that can ship governance, reliability, and choice fast enough to stay relevant.

Indonesia is the simplest example of the thesis. The “Indonesia Central” cloud region is a concrete bet that the next wave of AI demand comes from outside the United States. Quiet, infrastructure-first expansion is how you win global AI in 2026: by being deployable where compliance, sovereignty, and procurement constraints are the real moat.

The Dollar’s Quiet Fade – And Microsoft’s Offshore Windfall

AI buying decisions now start with jurisdiction, not features.

The “de-dollarization” story is often exaggerated — but the measurable trend is slow diversification. IMF COFER data shows the U.S. dollar share of disclosed global FX reserves has been edging down for years, reaching the mid‑50% range by late 2025, while total reserves climbed to roughly $13 trillion. That is not a collapse. It is risk management — and it matters because it signals how governments and large institutions are trying to reduce single‑country exposure.

At the same time, the dollar’s 2025 performance was weak by recent standards. A softer dollar doesn’t automatically change reserve allocations — but it increases sensitivity to currency risk and pricing power. For non‑U.S. buyers, especially governments and regulated enterprises, AI infrastructure is now a multi‑year commitment. They don’t want costs whipsawed by FX volatility or policy decisions they cannot influence.

This is where Microsoft’s non‑U.S. footprint becomes practical, not ideological. Azure can price and contract in local currency, operate through local entities, and pair AI deployments with sovereignty guarantees — all of which reduces procurement friction. In a world where AI is increasingly treated as strategic infrastructure, buyers care about things hyperscalers used to treat as secondary: data residency, legal jurisdiction, export controls, supply‑chain constraints, and the risk of being forced to unwind a deployment because policy changes. Microsoft’s proposition is not that it has the best model — it’s that it is deployable under more rule‑sets.

This also connects directly to the utilisation story. Datacenters don’t pay back through U.S. demand alone — they pay back when the next wave of workloads comes from Jakarta, Mumbai, and São Paulo. That’s why sovereign cloud commitments, EU boundary controls, and local billing are no longer edge cases; they are increasingly standard procurement criteria.

None of this means the dollar loses its role in 2026. The point is narrower: as reserve managers diversify and the currency regime becomes less one‑directional, large buyers become more comfortable building AI infrastructure outside a U.S.-only footprint. That is the demand environment where Microsoft’s neutrality strategy becomes commercially valuable — not because it is morally superior, but because it lowers procurement friction.

If Microsoft wants to win those markets at scale, it will need an operating model built for speed — not legacy bureaucracy.

That same dynamic also explains why Microsoft’s AI monetisation strategy became a central theme in the AI squeeze thesis: pricing power is harder to defend when switching costs collapse.

The Cost of Speed: Layoffs Aren’t Tragedy — They’re Accountability

Speed isn’t culture — it’s structure.

Layoffs are becoming part of Microsoft’s operating model — not an emergency lever. 2025 made that clear. Microsoft confirmed multiple rounds of job cuts across the year, including a widely reported wave of roughly 9,000 roles in July 2025 that hit gaming and other orgs. In most eras, that would be framed as cost discipline. In the AI era, it is closer to structural redesign.

The driver isn’t simply “needing fewer people.” It’s reallocating scarce budget and management bandwidth toward the only line of business that can defend the valuation: cloud and AI infrastructure. Across 2025, reporting repeatedly linked headcount reduction to freeing room for AI investment. Microsoft’s own messaging has also been consistent: simplify the structure, reduce handoffs, and ship faster.

Microsoft leadership has been unusually explicit about what it wants: faster execution, fewer handoffs, and less internal friction. The company is not alone — hyperscalers are restructuring as AI turns software firms into capital‑intensive infrastructure operators. When that shift happens, headcount isn’t primarily a moral debate; it becomes a balance‑sheet and operating‑model decision.

That matters because the competitive cycle has collapsed. Open-source releases land quarterly. Frontier labs iterate weekly. Product expectations reset every six months. A company built for multi‑year Windows and Office cycles cannot survive that tempo with a tall org chart, slow approval loops, and teams optimising for internal alignment instead of customer outcomes.

So the question in 2026 isn’t whether there will be more cuts — it’s where they land. The high‑value work is obvious: cloud reliability, security, enterprise AI tooling, data‑center operations, and model deployment. The low‑value work is just as obvious: redundant management layers, “strategy” functions disconnected from revenue, and product initiatives that exist because they once mattered, not because customers still pay for them.

From what we’re seeing across public chatter, this is also a morale story. A lot of Microsoft employees appear nervous — not because they doubt the company’s survival, but because they can’t clearly tie their day-to-day work to revenue or utilisation. In an AI capex cycle, that anxiety is rational: teams that aren’t driving usage, reliability, or monetisation will feel pressure first.

This is where the public conversation often goes wrong. The default story assumes cuts are random. In reality, investors are demanding evidence that FY25’s build‑out turns into utilisation and durable cash flow. When free alternatives get better and switching costs fall, companies that ship commercially illiterate work — products that miss their customers — and defend margins with price hikes instead of value don’t get to keep the same structure forever.

The utilisation and capex story is at the core: capital spent on infrastructure only pays off if the company can reallocate talent and resources quickly enough to drive real usage and margin.

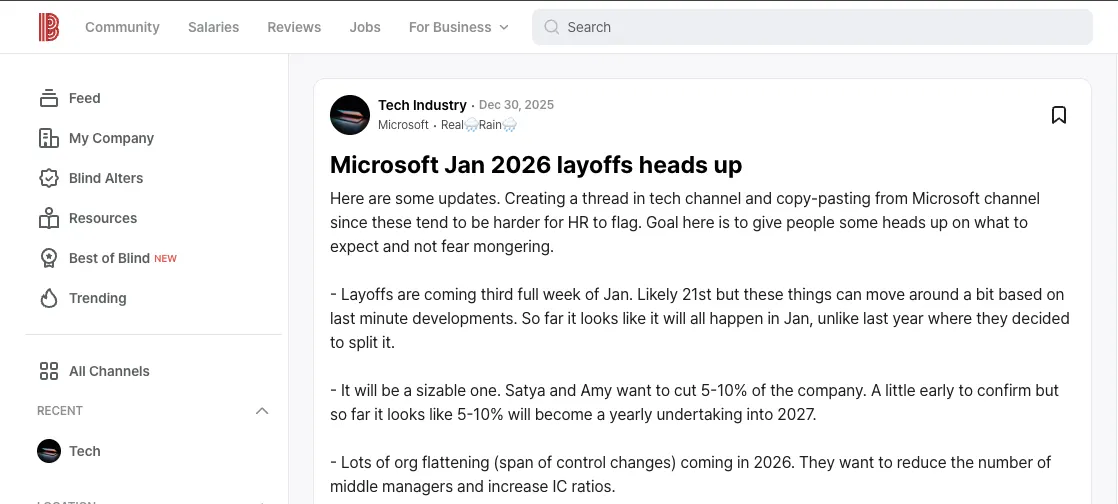

Insider chatter on forums like Blind suggests Microsoft layoffs in January 2026 could include another restructuring wave — but those claims should be treated as sentiment, not fact. What matters for investors is not whether a forum rumor is “right.” It’s whether the rumor is believable enough to spread fast, hit morale, and force a public response.

In early January, a widely circulated claim of a major Microsoft layoff wave spread across social channels and employee forums. Microsoft’s communications chief Frank X. Shaw publicly dismissed the reporting as “100% made up,” with coverage noting that the rumor narrative had outpaced any verified plan. The point isn’t to relitigate the rumor. The point is that it matched the cost-pressure logic closely enough that it became a credibility event: if the org has to deny it, the market has already learned it’s plausible.

Takeaway: even when a “layoffs leak” is wrong, it can still be a signal — not of headcount, but of pressure, belief, and how primed the org is for restructuring as part of the AI capex cycle.

Blind became the distribution layer for the rumour — useful as a sentiment signal, not a primary source of truth.

Not a Prediction. A Map.

Scenario outcomes are driven by utilisation, sovereign procurement, and execution speed.

This is not a neat “buy” or “sell” story. It’s a conditional story. A Microsoft stock price prediction for 2026 only makes sense if you first define what has to go right — and what has to break — across the business.

Here’s our MSFT stock outlook in plain language: Microsoft is still strong enough to survive the legacy decline, but only if Azure turns the FY25 infrastructure build‑out into real utilisation and global recurring revenue before competitors catch up.

These ranges are not magic. They reflect how the market typically reprices Microsoft when Azure growth accelerates or slows, when operating margins expand or compress under infrastructure spend, and when investors gain or lose confidence that capex turns into utilisation. In other words: the forecast is a sensitivity map across a few dominant variables, not a single-point guess.

So instead of pretending we can name an exact price, we treat this as a scenario forecast tied to operational drivers:

Base case (most likely): $430–$520 — Azure growth moderates but stays healthy, Foundry expands as a multi‑model enterprise layer, and Microsoft keeps landing sovereign and non‑U.S. contracts. Office and Xbox remain pressured, but don’t crater. Capex plateaus, utilisation rises, and margins hold. This is the “boring win”: a stock that grinds higher because the cloud cash engine stays intact.

Confirmation signal: Azure growth stays competitive, management language shifts from “build” to “utilise,” and Microsoft continues announcing sovereign or non‑U.S. wins without needing heavy discounting.

- Azure growth stays resilient (no sharp deceleration) and remains competitive versus AWS/GCP

- Capex plateaus while utilisation improves (visible in margin stability and revenue per capacity)

- Foundry adoption expands as a practical multi-model layer for enterprise deployments

- Sovereign and non‑U.S. procurement wins continue at a steady pace (no stall in public-sector/regulated deals)

- Operating margins hold or improve slightly despite continued AI infrastructure spend

Bull case (execution win): $520–$600 — Non‑U.S. Azure growth accelerates, Foundry becomes a default procurement platform for model choice, and Microsoft’s neutrality strategy translates into outsized international adoption. Sovereign cloud commitments become the standard buying path, and Microsoft successfully flattens the organisation to move at AI speed. In this scenario, the market rewards Microsoft not for legacy dominance, but for becoming the neutral backbone of global enterprise AI.

Confirmation signal: international Azure becomes a headline driver in earnings, Foundry is cited as a standard enterprise deployment layer, and margins expand as utilisation catches up to the build‑out.

- Non‑U.S. Azure accelerates meaningfully (international mix becomes a headline driver)

- Foundry becomes a default procurement platform for multi‑model deployment, not just a product add‑on

- Sovereign cloud commitments translate into repeatable, scaled contracts across multiple jurisdictions

- Organisational flattening shows up as faster shipping cycles (fewer handoffs, quicker enterprise releases)

- Margins expand as utilisation catches up to FY25’s build‑out and pricing power improves

Bear case (stagnation): $350–$430 — Capex plateaus but utilisation disappoints. AI workloads shift toward competitors or in‑house infrastructure. Xbox and Microsoft 365 face deeper pricing backlash. Restructuring becomes churn instead of acceleration. The stock doesn’t collapse, but it gets repriced as a slow‑moving conglomerate rather than an AI infrastructure leader.

Confirmation signal: Azure growth decelerates sharply, investors question utilisation despite capex flattening, and Microsoft begins defending pricing through bundling, discounts, or churn-mitigation tactics.

- Utilisation disappoints (capex plateaus but revenue per capacity fails to rise)

- Azure competition intensifies and Microsoft loses AI workloads to AWS/GCP or in‑house builds

- Pricing backlash deepens across Microsoft 365 and Xbox (forcing discounting or churn)

- Restructuring creates churn instead of speed (talent loss, slower releases, internal disruption)

- Margins compress as infrastructure costs stay high but revenue growth softens

The simplest way to read 2026 is this: Microsoft is still an empire — but it’s an empire being forced to learn speed. If it can prove utilisation, win the sovereign procurement wave, and keep Foundry’s model choice credible, the stock can work. If it moves like it’s 2015, it won’t.

And there’s a human layer to the same story. When employees can’t connect their work to utilisation, customer outcomes, or revenue, anxiety rises — and so does organisational fragility. In an AI capex cycle, that pressure is not personal; it’s structural. Microsoft will protect the teams that drive reliability, adoption, and monetisation. Everything else will be asked to justify itself faster than it’s used to.

Key metrics to watch in 2026: Azure growth rate (and non‑U.S. mix); operating margin trajectory; capex + finance lease commitments; Azure AI Foundry adoption; sovereign cloud contract wins.

What would change our view: a clear utilisation miss after FY25’s build‑out, or evidence that AI workloads are migrating away from Azure faster than Microsoft can replace them with sovereign and non‑U.S. demand.

This isn’t financial advice. It’s a framework — built from public signals — for how to think about Microsoft’s year ahead.

Sources & Notes

All figures and claims in this editorial should be read alongside their original references. Where exact numbers are cited, sources are provided as direct links or formal citations below.

Microsoft financials, capex, and guidance

- Microsoft FY25 Annual Report — primary reference for FY25 revenue, capex, and related financials.

- Microsoft SEC Filings Index — source for Microsoft’s FY25 Form 10-K and other official filings referenced for infrastructure and accounting details.

- Reuters: “Microsoft plans to spend $80 billion on AI-enabled data centers in fiscal 2025” (Jan 3, 2025) — reporting used to support the scale of AI infrastructure spend and capex estimates.

- Financial Times: “Microsoft shares jump after strong AI demand lifts cloud unit” — coverage of capex context, cloud demand, and share price reaction.

- MacroTrends: Microsoft stock price history (MSFT) — supporting context for market valuation and price trends.

Microsoft Investor Relations earnings commentary

- Microsoft Investor Relations: FY26 Q1 earnings page — source for capex guidance and management language on utilisation.

- Microsoft Investor Relations: FY25 Q4 earnings page — additional reference for FY25 end-of-year results and commentary.

Windows, Windows 11 adoption, and Linux/SteamOS indicators

- StatCounter Global Stats: Desktop Windows version market share — cited for Windows 10/11 adoption and upgrade lag.

- Steam Hardware & Software Survey — supporting data for OS share among gamers and Linux/SteamOS momentum.

- PC Gamer: “Linux gaming has never been better” — referenced for Linux gaming improvements and mainstream coverage.

Microsoft 365 pricing, Copilot positioning, and product changes

- Microsoft 365 Blog: “Advancing Microsoft 365: new capabilities and pricing update” (Dec 4, 2025) — pricing update and value framing for Microsoft 365 and Copilot.

- Microsoft: 2025 Work Trend Index — adoption/usage context referenced for Copilot messaging and seat-level reality.

- Microsoft Support: “Skype is retiring in May 2025: What you need to know” — product change cited in the M365 section.

Xbox Game Pass pricing and console strategy signals

- Xbox News: “Xbox Game Pass Ultimate, Premium & Essential plans” (Oct 1, 2025) — pricing update for Game Pass tiers and rationale.

- Reuters: “Microsoft raises prices on Xbox Game Pass Ultimate” (Oct 1, 2025) — reporting on Game Pass price changes and subscriber sentiment.

- The Verge: “Microsoft is bringing four Xbox games to PlayStation and Switch” — coverage of Microsoft’s cross-platform strategy and exclusivity shifts.

Azure AI Foundry, model choice, and sovereign cloud commitments

- Microsoft Azure Blog: “Grok 4 is now available in Azure AI Foundry” (Sep 29, 2025) — used to support Foundry’s multi-model positioning and the platform-layer thesis.

- Business Today: “Musk praises Tesla AI leap enabling 8-bit chips to deliver 32-bit intelligence” (Jan 17, 2026) — used as a recent example of the industry-wide shift toward efficiency (mixed precision / quantisation) as a competitive lever.

- Microsoft Azure AI Foundry documentation overview — overview of Foundry’s multi-model approach and platform positioning.

- Microsoft: “Microsoft opens Indonesia Central cloud region” (May 27, 2025) — confirms the Indonesia Central region launch and Microsoft’s long-term investment in local cloud infrastructure.

- Microsoft EU Data Boundary update page — cited for EU data boundary and compliance commitments.

- Microsoft Sovereign Cloud overview — referenced for sovereign cloud product strategy and commitments.

- Azure Charts: “Updates in January 2026” — consolidated feed used to support the claim that Azure’s operational update cadence remains high in early 2026.

Germany sovereign cloud (Delos Cloud) and public sector procurement

- Microsoft Blog: “Announcing comprehensive sovereign solutions empowering European organizations” (Jun 16, 2025) — confirms the Delos Cloud agreement and Microsoft’s European sovereign cloud strategy for regulated/public-sector buyers.

- Delos Cloud overview — operator background and sovereign cloud positioning for German public sector infrastructure.

- Delos Cloud press release PDF (Sep 23, 2024) — primary document confirming contracts and operating model for German public-sector sovereign cloud.

- Bertelsmann / Arvato: “First sovereign cloud platform for the German administration on the home straight” (Sep 24, 2024) — third-party confirmation that Delos Cloud, Microsoft, and Arvato Systems signed final contracts for German administration sovereign cloud.

Saudi Arabia (Aramco Digital) distributed cloud partnership

- PR Newswire: “Aramco Digital, Armada, and Microsoft collaborate to deploy world’s first industrial distributed cloud” (Feb 2025) — joint announcement describing industrial distributed cloud hubs and Azure integration for real-world AI workloads.

- Armada: “Aramco Digital, Armada, and Microsoft collaborate…” — implementation detail on edge data-center hubs and how the distributed cloud model connects to Azure services.

India (Reliance Jio) Azure partnership

- Microsoft India Newsroom — source for Microsoft + Reliance/Jio partnership and regional cloud expansion.

IMF COFER reserve composition and dollar diversification

- IMF COFER: Currency Composition of Official Foreign Exchange Reserves — primary dataset for USD share trends in disclosed FX reserves and long-run diversification patterns.

- IMF COFER portal (interactive tables) — reference view used for the mid‑50% USD share discussion and reserve totals context.

Layoffs reporting and sentiment indicators

- CNBC: “Microsoft layoffs 2025 (over 15,000)” (Jul 24, 2025) — reporting used for layoffs timing, scale, and company messaging.

- Windows Central: “Microsoft’s Frank Shaw refutes massive layoff rumors” (Jan 2026) — coverage of the viral layoff claim and Microsoft’s public denial, used as context for how rumor cycles become morale/credibility events.

- GameSpot: “Microsoft Exec Dismisses Mass Layoff Report: ‘100% Made Up’” (Jan 2026) — secondary coverage citing Shaw’s denial.

- Blind (TeamBlind) — employee sentiment and layoff/rumor discussion forum (note: sentiment/rumor, not official data).

- Blind thread: “Microsoft Jan 2026 layoffs (heads up)” — the specific post referenced in this article (sentiment/rumor only; not official confirmation).